The Laffer Curve of Philippine tobacco taxation

Home Editors’ Picks The Laffer Curve of Philippine tobacco taxation

The Laffer Curve of Philippine tobacco taxation

May 22, 2023 7:08 pm

My Cup Of Liberty

Bienvenido S. Oplas, Jr.

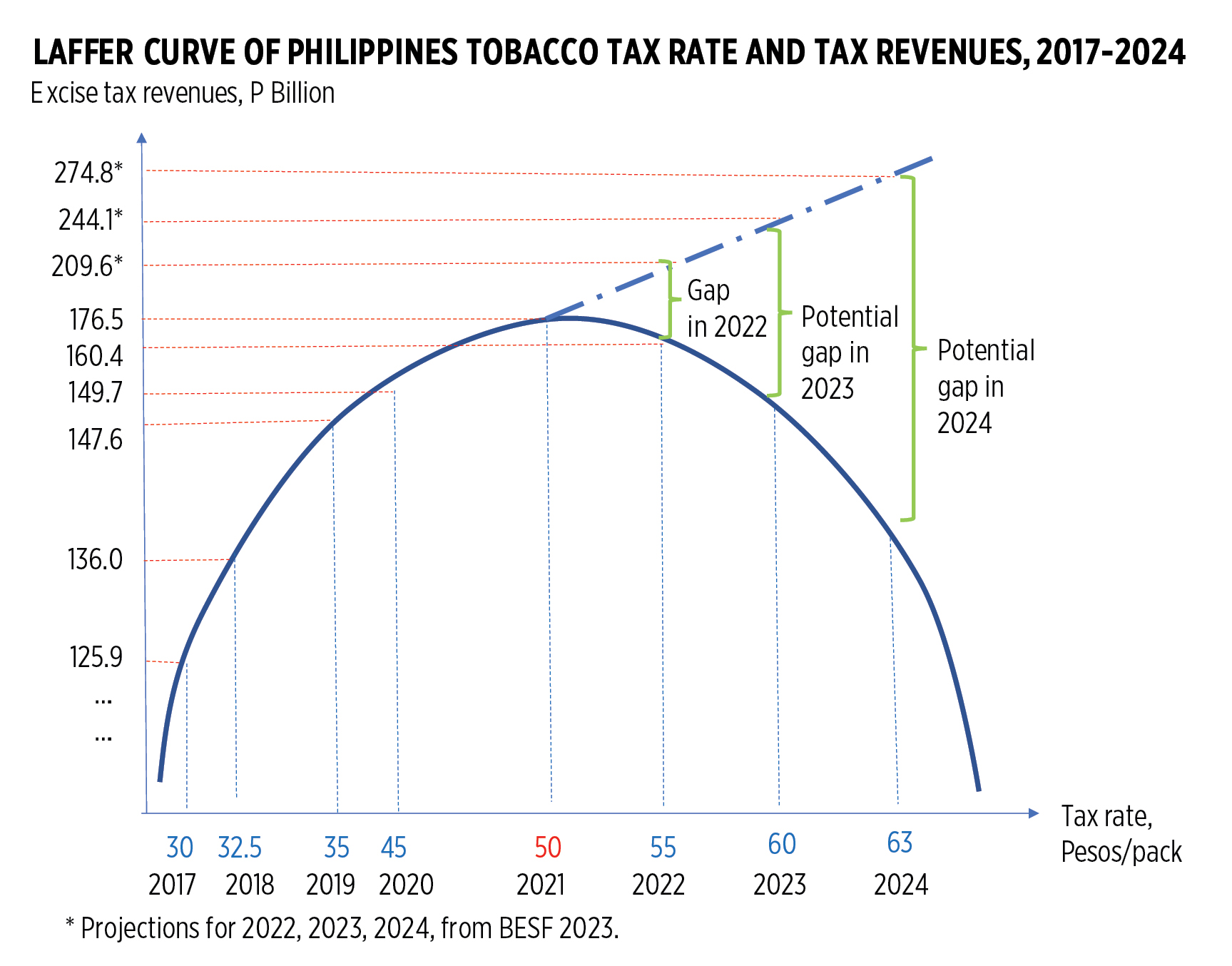

One important concept in Public Finance Economics is the Laffer Curve. It shows a bell-shape relationship between tax rates and revenues: as tax rates increase, revenues also increase initially then plateau at some point and start to decline after. The concept was developed by US economist Arthur Laffer.

Consider income tax. At 20% to 30% tax, people would tolerate it. But as income tax rises to 40% and higher as their income rises, some people would reduce work to an income level where the tax rate is only 30% or lower and instead enjoy more rest. Other people would misdeclare their real income, like getting a second or third job and not declaring it because their tax rate would then jump to 50% or higher. This undeclared, unreported income is considered among “underground economy” activities and tax collection on this is zero. And the government’s overall revenues start to decline.

This column has discussed the Philippines’ excise tax revenues from “sin” or “public bad” products — alcohol, mining, petroleum, sugar-sweetened beverages, tobacco — before (“Taxpayers’ burden from uniformed pensions,” May 1). Tobacco tax revenues were the highest in the following years: P126 billion in 2017, P136 billion in 2018, P148 billion in 2019, P150 billion in 2020, P176 billion in 2021, and P160 billion in 2022. Tobacco tax revenues experienced a decline for the first time in 2022, coinciding with the big tax rate imposed — P55/pack — and as more people shifted to smuggled or illicit tobacco products which are very cheap.

This column has also previously discussed estimates of tax losses from cigarette smuggling alone: Congressman Joey Salceda, the Chairman of the House Committee on Ways and Means, put it at P30 billion/year; former party-list congressman Jericho Nograles, said it was P31 billion/year; Jesus Aranza, Chairman of the Federation of Philippine Industries (FPI), said it was P25 billion/year; and Bureau of Internal Revenue (BIR) Commissioner Romeo Lumagui, Jr., put it at a whopping P100 billion/year. See Table 2 in the column “Addressing high inflation and tax leakage” of March 13.

I constructed this illustration of a Laffer Curve using data on actual tobacco tax collections from 2017-2022, then projected collections for 2022-2024, and the tax rates per pack. So a tax rate of P30/pack in 2017 yielded P126 billion in revenues; P50/pack in 2021 yielded P176 billion revenues; P55/pack in 2022 yielded P160 billion, versus the projection of P210 billion in the Budget of Expenditures and Sources of Financing (BESF) 2023.

This represents P50 billion (P210 billion minus P160 billion) in unrealized revenues, which is midway and consistent with the various estimates of P30 billion to P100 billion in yearly tax losses from tobacco smuggling and illicit trade.

If this trend continues, the potential revenue gap in 2023 could be as high as P90 billion, and even larger in 2024 (see Figure 1).

So, from a Laffer Curve analysis, the optimal tax rate — where tax revenue is largest — is P50/pack. The P55/pack imposed last year yielded a decline in revenues. Government is worse off while smugglers, criminals, and their protectors in government are better off.

Assume tax losses of P50 billion from smuggling in 2023 and beyond. If this can be cut to just half via better law enforcement by national and local governments, the P25 billion in additional revenues can do any of these, and more:

1. If used to subsidize electricity prices, this will lead electricity that is cheaper by P0.23/kwh (P25 billion/110 billion kwh), for all on-grid consumers nationwide.

2. If used to retire some public debt, this will lead to savings of P26.5 billion/year (P25 billion principal plus P1.5 billion in interest at the current 6% a year Treasury-bills and Treasury-bond rates).

3. Such savings can fund a Targeted Cash Transfer (TCT) program covering 7.60 million households. For 2022, the Department of Budget and Management released P27.1 billion for the TCT program — P19.43 billion last year and a follow up of P7.68 billion last week.

Last week, on May 18, The Economist Impact organized a big conference, “Global Anti-Illicit Trade Summit, South-East Asia,” at the Shangri-La The Fort at BGC in Taguig City. The keynote speech was given by BIR Commissioner Romeo Lumagui, Jr. Among the things he said was, “the damage that illicit trade can wreak on an economy… most immediate impact is the loss of tax revenues that are urgently needed to fund development efforts.” He also pointed out the “unfair competition between the players in these illegal activities and legitimate business enterprise… money generated from illicit trade is used to fund organized crime, resulting in heightened security risks both locally and internationally.”

Then he discussed four measures that the government can take to control smuggling and illicit trade, especially of tobacco products. These are: a.) improved border controls, b.) enhancement of intelligence networks and interagency coordination between the country’s key law enforcement agencies, c.) have a comprehensive legal framework on trade of products in “brick-and-mortar” stores and e-commerce platforms, and, d.) strict enforcement of applicable laws and regulations against illicit trade and new anti-illicit trade legislation.

I think these measures are practical and workable. In addition, the Commissioner and Congress may also consider two other policies that I propose.

One, freeze the tobacco excise tax to between P50 to P55/pack. Reduce the price gap between legitimate tobacco — the cheapest pack now costs P120 (P60 of which is excise tax alone) vs the prevailing smuggled tobacco price of only P40/pack. A lower price differential between the legal and illegal products can lead to reduced consumption of the latter.

Two, partially peg the annual budget of law enforcement agencies like the Philippine National Police, Philippine Coast Guard, and National Bureau of Investigation on revenue collections from excise tax, especially tobacco products. If excise tax collections (with the oil excise tax removed) flat line or decline, these agencies’ budgets will be affected for the worse. This way, there is an incentive among the agencies to strictly enforce laws against illicit trade and products.

FEWER BIRTHS

There has been an alarming, consistent decline in the number of births in the Philippines starting during the 2020 lockdown, then the mass vaccinations starting 2021. There were nearly 30,000 fewer births a month in 2022 than in 2019. This is not good (see Figure 2).

The lockdowns of 2020-2021 plus the mass vaccinations of 2021-2022 — or political tyranny plus medical tyranny — coincided with, if not triggered, the reduction of births in the Philippines.

The proposed Senate Bill 1869 creating a new bureaucracy —the Center for Disease Control (CDC) — is a dangerous bill. Among the coercion explicitly provided for in the bill is “Promote treatment, vaccination, or immunization against a contagious disease, compelling the isolation or quarantine of persons who are unable or unwilling, for reasons of health, religion, or conscience, to undergo immunization or treatment” (Section 13, #5).

Mandatory vaccination or mandatory isolation is equivalent to mandatory discrimination. The vax-vax-vax narrative and business has contempt for the natural immunity developed by people and only believes in “vax immunity.” It only believes in virus mutation but not human mutation in response to new viruses and bacteria. It is a dishonest narrative and now senators want to institutionalize the dishonesty via legislation. SB 1869 is political and medical tyranny. It should not be passed.

Bienvenido S. Oplas, Jr. is the president of Bienvenido S. Oplas, Jr. Research Consultancy Services, and Minimal Government Thinkers.