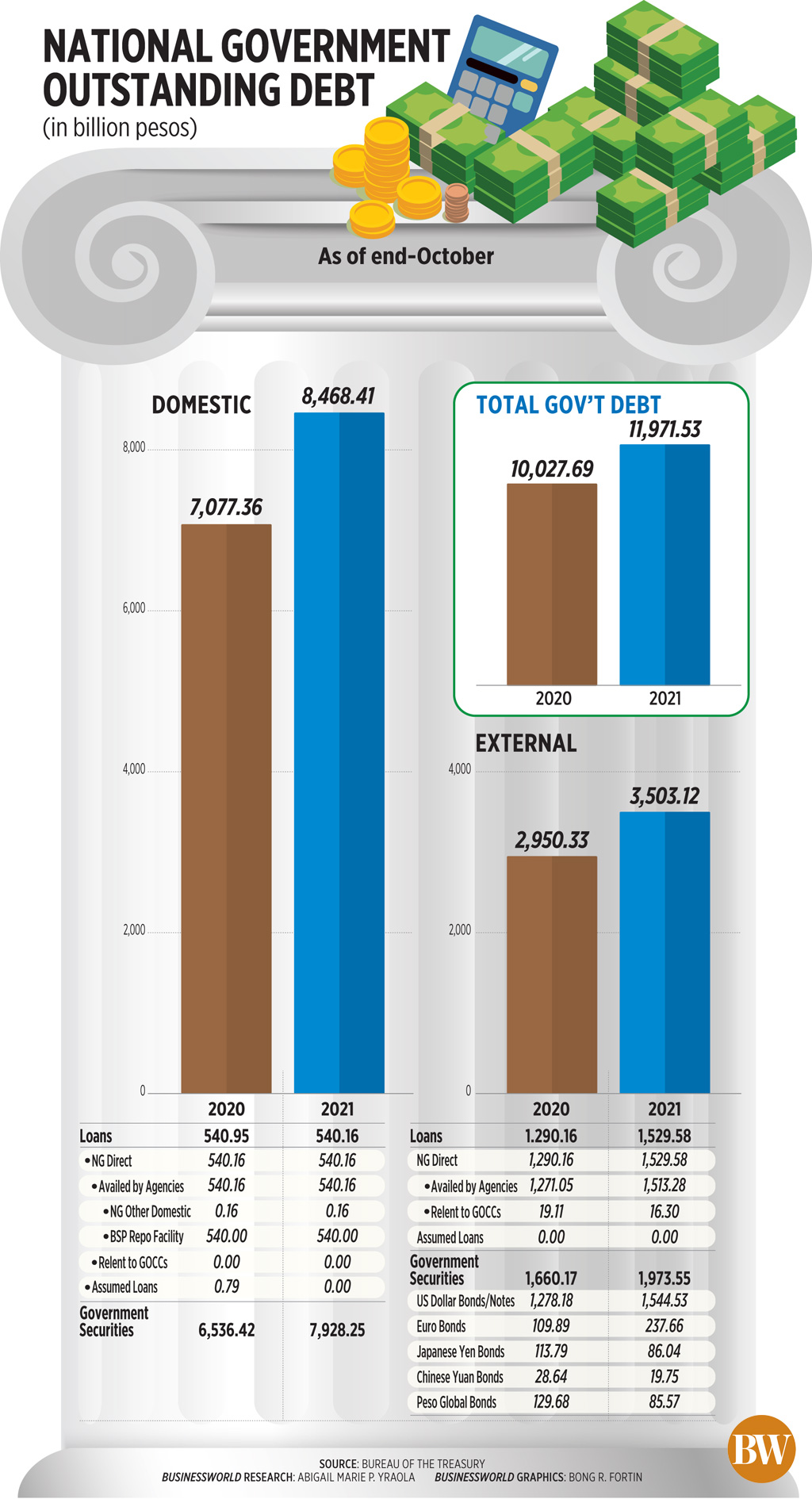

Nat’l Government debt swells to P11.97 trillion

THE NATIONAL Government’s outstanding debt swelled to P11.97 trillion as of the end of October as it o

ff

ered more domestic securities, preliminary data from the Bureau of the Treasury (BTr) showed.

The end-October debt level was 19.38% higher year on year and edged up by 0.46% from September.

BTr in a statement on Wednesday said the debt increase was “primarily due to the net issuance of domestic securities.”

Government debt rose by 22.2% since the start of the year, or the equivalent of P2.18 trillion over the 10-month period.

The 10-month debt

fi

gure is also higher than the P11.73-trillion government target for the year.

Domestic borrowing accounted for 70.7% of the total, while the rest was sourced from foreign creditors.

Broken down, domestic debt at the end of October went up by 0.96% to P8.47 trillion from September. Domestic debt stock grew by 19.65% year on year.

Outstanding government securities jumped by 1.03% to P7.93 trillion from the end-September level. This also surged by 21.3% from the same period last year.

The government still owes the P540 billion it borrowed from the central bank to continue funding the country’s pandemic response.

Meanwhile, external debt declined by 0.74% to P3.5 trillion month on month, but jumped by 18.74% from October 2020.

“For October, the lower figure for external debt was attributed to the impact of local and foreign currency exchange rate adjustments amounting to P22.68 billion and P8.45 billion respectively,” BTr said.

“This more than o

ff

set the net availment of external obligations amounting to P4.96 billion.”

Broken down, foreign debt consisted of P1.53 trillion in loans, declining by 0.82% since end-September.

Government securities also slipped by 0.68% to P1.97 trillion in October.

This included P1.54 trillion in dollar notes, P237 billion in euro bonds, P86 billion in yen paper, P19.75 billion in yuan notes and P85.6 billion in peso global bonds.

The National Government’s total guaranteed debt slipped by 1.48% to P426.46 billion in end-October from a month earlier, and 4.77% from a year ago.

“The lower level of guaranteed debt was due to the net redemption of domestic and external guarantees amounting to P1.24 billion and P0.08 billion, respectively,” the Treasury said.

“Currency adjustment on both local- and third-currency denominated guarantees also trimmed P1.28 billion and P2.25 billion, respectively.”

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said foreign debts declined month on month as the stronger peso exchange rate in the latter part of October reduced the level of foreign borrowings when converted to pesos.

He said in a Viber message that a narrower budget de

fi

cit could have led to a reduced need for additional borrowings, which would improve fiscal performance and debt management.

“As a result, the growth in outstanding debt slowed both on a month-on-month and year-on-year basis, as the economy further reopened from lockdowns and towards greater normalcy, which increases government tax revenue collections and reduces government expenditures.” —

Jenina P. Ibañez