Making meaningful connections through customer experience

There is a natural disparity in the conversation about digital transformation. While the accessibility and affordability of technology nowadays have created digital natives out of the average consumer, the same cannot be said for businesses, particularly those in fields as established as the financial services industry.

On the contrary, digital transformation for such industries are often expensive, arduous processes that take years of planning and strategizing.

Kame Amado-Gomez, head of digital networks at Singlife Philippines, the first and only 100% digital insurance company in the Philippines, pointed out that many incumbents in the insurance industry have not innovated their digital customer experience (CX) journey past the purchasing stage.

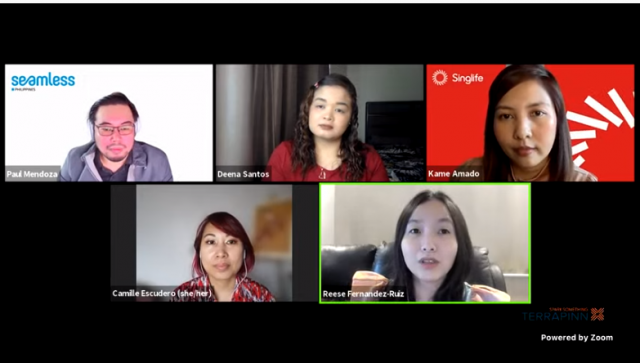

“When we were doing these design processes, we noticed that most life insurers or the incumbents currently touting to be digital say that they are focused on CX, but when you really take a look at the experience that they offer, most of them stop at the buy or the purchase journey,” she said during a panel discussion at the Seamless 2021 virtual conference.

“Sure, you can buy insurance online, but activating your policy will take you another day or two and if you want to manage your policy, or view your contract, or make any changes, or file a claim, most probably you’ll still have to move to another platform and undergo disjointed and manual processes,” she added.

Such an approach limits the insurers from engaging with and building an authentic connection with their customers, as it fosters a ‘buy and forget’ relationship. This was far from Singlife’s goal. When they entered the Philippine market, Ms. Amado-Gomez shared, Singlife had the bold ambition of disrupting the status quo of an age-old insurance industry by going 100% digital.

“For us, that meant a lot of unlearning the traditional ways of thinking, dreaming up new ideas and concepts, and trying to redefine how insurance is being experienced currently,” she explained.

“If you try to buy a Singlife product through GCash, you will actually be able to complete the purchase journey in less than five minutes. You’ll get your policy contract instantly, as in a matter of seconds. You don’t have to wait. You get to view your policy details and even file a claim without having to leave the GCash app,” she added.

Furthermore, customers who want to cancel their policies can receive their refunds directly through their GCash wallet in real time. Customers can even opt to receive claim payouts through the same feature.

Singlife’s customer-centric approach to their insurance services have netted the company a customer satisfaction of 92%, with 90% of its customers retaining their policy every month. In addition, 7% of these customers opt to buy an additional product from the company, a relatively high percentage compared to the industry standard of 2-3% of customers buying another insurance policy.

Transparency and authenticity

Ms. Amado-Gomez advised other companies starting on their CX journey to start small and realize that redesigning an end-to-end customer journey and changing an organization’s mindset regarding that journey cannot be done overnight.

“So pick low-hanging fruit or one particular use case that you believe will make a sizable impact in your organization. Make sure to monitor the results and gather actionable insights from that initiative. Because these insights although gained at a small scale but applied often can be used to build on and continuously improve your overall CX over time,” she said.

“One more important thing that I learned in my own CX journey is to not treat it like a separate function or limit your strategy to just the front-end experience. There’s still this misconception that CX is just the website design or your UX UI design, which it is not. CX encompasses all aspects of the business. It is a reflection of your brand promise. Good CX will amount to nothing if you don’t have a good product. All the pretty screens and interactions that you design will be wasted if you don’t have the tech and the supporting back-end processes in place.”

With the growing prevalence of on-demand services, customers have come to demand more from businesses. As such, the landscape is set to further evolve to meet those demands.

“At Singlife, there is constant effort to build real-time processes, do away with unnecessary steps for the customers and really invest in smarter technologies that can support all these innovative experiences that we dare to imagine,” she said.

“To succeed in CX you have to genuinely love your customers. You have to find it fulfilling that you make them happy.”

To know more about Singlife Philippines, visit

https://singlife.com.ph/

.

Spotlight is BusinessWorld’s sponsored section that allows advertisers to amplify their brand and connect with BusinessWorld’s audience by enabling them to publish their stories directly on the BusinessWorld Web site. For more information, send an email to

online@bworldonline.com

.

Join us on Viber to get more updates from BusinessWorld:

https://bit.ly/3hv6bLA

.