Tax reform in progress

Tax reform in progress

Tax reform in progress

October 11, 2021 6:23 pm

MAP Insights

Raymond A. Abrea

Why is our tax system inefficient? The simple answer is that we have a very narrow taxpayer and tax base. According to UN data, the current population of the Philippines as of Oct. 3, 2021 is 111,404,546, meanwhile there are 24,015,416 total registered individual taxpayers as of Dec. 31, 2020 per the 2020 Annual Report of the Bureau of Internal Revenue (BIR) — so only 21.56% of the total population are taxpayers, of which 20 million are compensation-income earners or employees who are mostly minimum wage earners or tax-exempt under the TRAIN Law.

While there are developments and tax administrative reforms implemented by the BIR, the tax effort ratio pre-COVID-19 peaked at 14.49% which is the highest in 22 years as reported by the Department of Finance. According to the World Bank, tax revenues above 15% of a country’s gross domestic product (GDP) are a key ingredient for economic growth and, ultimately, poverty reduction.

The tax gap seems to be getting wider despite some tax reform measures enacted in the last five years. Before, tax evasion and smuggling appeared to be the major sources of tax leakages, but recent events have shown new forms and ways, like online transactions in the digital economy, investments in cryptocurrency, and an increasing number of offshore accounts in known tax haven countries, among others.

MANDATORY TIN

Mandating assignment of a Tax Identification Number (TIN) to every citizen seems to be the fast and easy solution to broaden the taxpayer base. This will allow the BIR to monitor who are minors or students, unemployed, gainfully employed, self-employed or professionals, incorporators or directors of corporations, and OFWs.

The lifting of the Bank Secrecy Law will make it easier for the tax administration to prosecute tax evaders, but as long as a TIN will be required in opening bank accounts, acquiring real properties or luxury goods including online transactions, any undeclared income or ill-gotten wealth can be traced.

This may require legislation, not just to make TIN mandatory but also as a pre-requisite before making any transactions. Thus, making TIN a depository account of all income received and expenses incurred by any individual or corporate taxpayers without having to check source documents.

MANDATORY REGISTRATION

Mandating registration of all sellers, influencers, or content creators before they can create an account or transact using any digital platforms will close the tax gap caused by the fast-growing digital economy.

This, however, is just the first step in on-boarding all new players or earners in this new economy. The government must legislate digital taxation which will fully define all entities, transactions, and platforms, recognizing their distinct and peculiar nature. Other than imposing taxes, the law must also incentivize those who will engage in online transactions to encourage registration and compliance.

Further, a budget appropriation is necessary to fund expertise and infrastructure to equip the tax administration in dealing with digital assets, cryptocurrency, and the like. Unfortunately, these are not included in the proposed Digital Economy Taxation Act of 2020 (HB 6765).

EASE OF PAYING TAXES

Congress has just approved House Bill 8942 or the Ease of Paying Taxes Bill which aims to further simplify tax compliance and modernize tax administration. Some of its salient features include removal of the P500 annual registration fee, removal of authority to print (ATP), requirement for receipts or invoices, and implementation of risk-based assessment among others.

While this complements the administrative reforms to improve ease of paying taxes initiated by the BIR and recommended by the Ease of Doing Business (EODB) Task Force, it lacks budget appropriation to fund the digital transformation and full automation of our tax administration including audit and assessment.

Also, further streamlining of tax compliance must result in the removal of the manual Books of Accounts and other supporting documents which are already reported in the Summary List of Sales and Purchases (SLSP). Scanned copies of receipts or invoices must also be accepted in lieu of the actual documents.

In summary, ease of paying taxes means a more streamlined paperless tax compliance which can be accomplished online without unnecessary printed documents to support transactions and substantiate deductible expense claimed, if applicable.

MANDATORY AUDIT

The BIR has successfully implemented and made use of third-party information in enhancing its tax audit and investigation. With full automation, where all transactions can be captured in each TIN account, and implementation of electronic invoicing pursuant to the TRAIN Law, computerized risk-based audit may also be adopted to avoid compromises between the assigned examiner and taxpayer being audited.

Mandatory audit must also be conducted for the following:

a. Political candidates and their campaign donors after every election;

b. Government officials vis-à-vis their filed SALN; and,

c. Government contractors and suppliers.

This will help rebuild the trust of the taxpaying public to know that public funds do not inure to the benefit of traditional politicians while collecting tax dues from any undeclared income or ill-gotten wealth.

Although annual audit is indispensable in the mandate of the BIR to assess and collect taxes, a computerized risk-based audit will help prioritize taxpayers with low or non-compliance, instead of “randomly” auditing the same companies every year. Mandatory audit may be conducted every three years to make sure all taxpayers are compliant, unless there’s prima facie evidence of violation or non-compliance.

FLAT TAX FOR SMALL BUSINESSES

High compliance costs and high tax rates are two of the reasons why non-compliance is prevalent among small businesses. A 10% flat tax based on gross income will eliminate the unnecessary compliance costs and regular audit since deductible expenses will no longer be claimed.

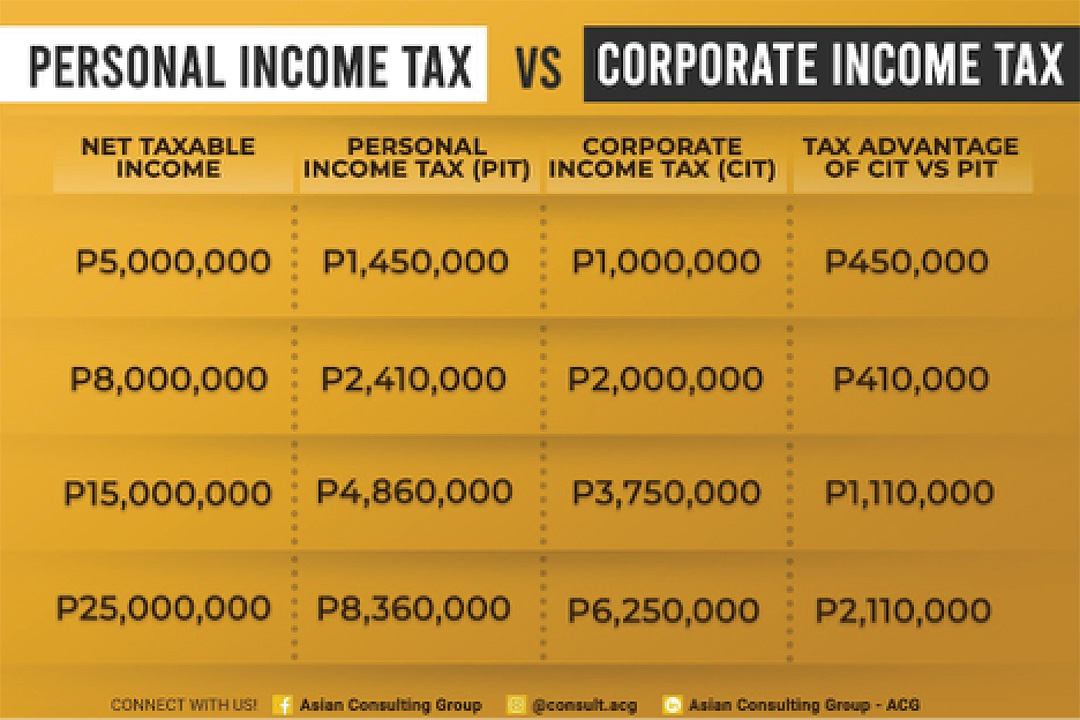

This is owing to the fact that most companies are paying an effective tax rate of 5% despite the higher income and businesses taxes imposed. Unfortunately, the CREATE Law created undue tax advantage for non-individual or corporate taxpayers with the reduced 20% or 25% corporate income tax versus the highest personal income tax at 35% for “ultra rich” taxpayers or those earning above P8 million (

See the Table

).

Here’s a brief discussion of the proposal:

1. A fixed tax from P1,000 to P5,000 may be imposed on marginal income earners based on location, target market, and years in operations to encourage all

sari-sari

stores, online sellers, and those in the underground economy to register. Currently, marginal income earners are those earning not more than P100,000 in annual sales. This can be increased to P500,000 – P1,000,000 to support livelihood initiatives;

2. Provide tax exemption for startups for their first two years or P1 million in income, whichever comes first. Startups must promote innovation and agriculture but must not be affiliated to any existing corporations or conglomerates to avoid abuse and unnecessary tax benefit to those who can afford to pay taxes;

3. Standardize the definition of small business whether registered as a sole proprietor or corporation. Use sales as threshold instead of asset value, e.g., P100 million and impose a flat 10% tax in lieu of all taxes to encourage registration and compliance;

4. Expand further the withholding tax system to cover all income payments of large and top taxpayers, including digital transactions. Allow optional final tax for certain income, e.g., commission of brokers, agents and influencers, to ensure tax collection without the burden of compliance costs;

5. Implement a general tax amnesty with a provision on lifting the Bank Secrecy Law for tax fraud cases so the BIR can focus on high-risk, big-time tax evaders.

Our tax system remains inefficient due to a narrow taxpayer base, high compliance cost, and high tax rates. In order to achieve a simpler, fairer, and more efficient tax system, the comprehensive tax reform program must include mandating TIN assignment and use in all transactions, mandatory registration, ease of paying taxes, and a flat tax for small businesses.

This will hopefully broaden the taxpayer base, lower compliance costs, and further reduce tax rates to encourage voluntary compliance. The next administration must continue the comprehensive tax reform program and consider the above-mentioned proposals to uphold honesty and integrity in paying taxes while running after tax evaders including corrupt politicians.

This article reflects the personal opinion of the author and does not reflect the official stand of the Management Association of the Philippines or MAP.

Raymond “Mon” A. Abrea is a member of the MAP Ease of Doing Business Committee, founding chair and senior tax advisor of the Asian Consulting Group, and co-chair of the Paying Taxes — EODB Task Force. He is a trustee of the Center for Strategic Reforms of the Philippines — the advocacy partner of the BIR, Department of Trade and Industry, and Anti-Red Tape Authority on ease of doing business and tax reform.