ADB maintains growth outlook for Philippines

ADB maintains growth outlook for Philippines

ADB maintains growth outlook for Philippines

September 23, 2021 12:33 am

Beatrice M. Laforga,

Reporter

THE ASIAN Development Bank (ADB) kept its Philippine growth forecast as more signs of recovery emerged, and warned that a premature withdrawal of support may threaten an already fragile recovery.

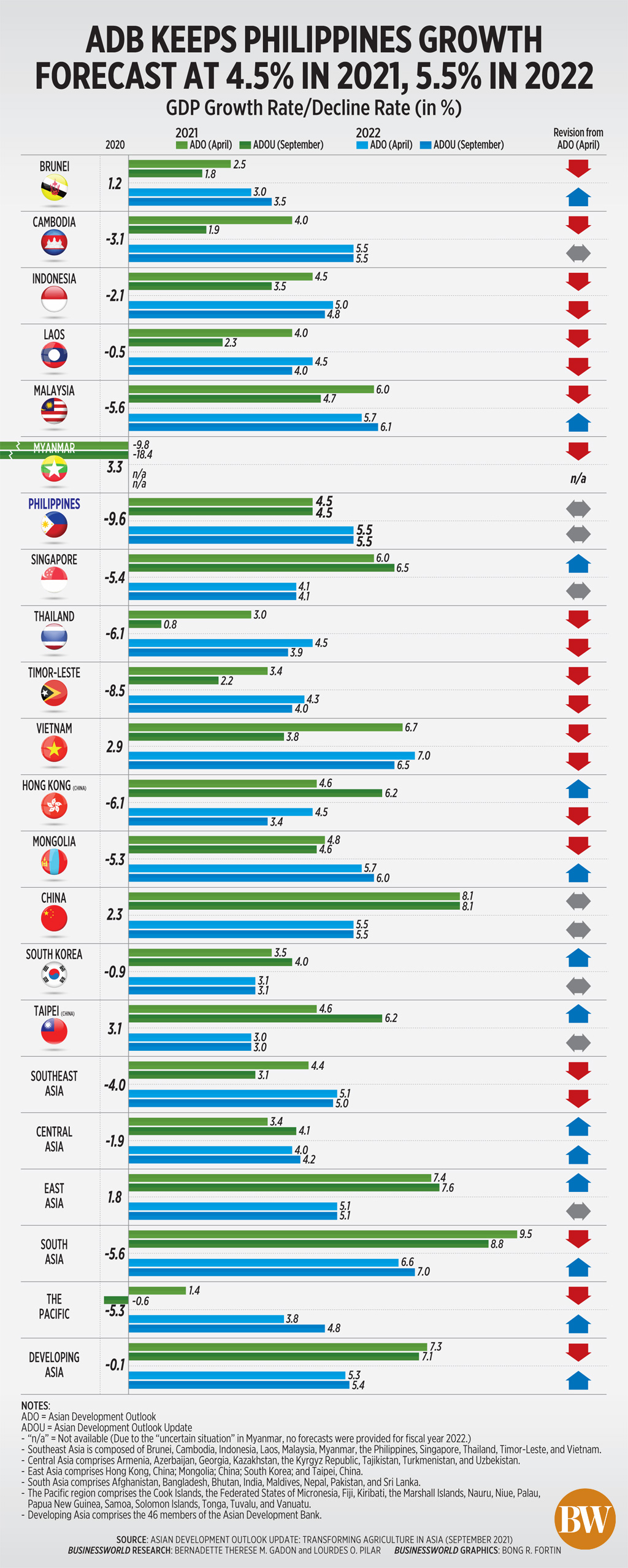

In its Asian Development Outlook (ADO) 2021 Update released on Wednesday, the multilateral bank said its gross domestic product (GDP) growth projections are maintained at 4.5% in 2021 and 5.5% in 2022.

“One of the reasons that we’re not adjusting our forecasts for the Philippines is if you look back to April, we started with a much more conservative view of how the vaccine rollout would come through as well as the removal of containment measures,” Joseph E. Zveglich, Jr., the acting chief economist of the ADB, said at a press briefing on Tuesday.

The ADB’s economic growth forecast for this year is still within the government’s already downgraded 4-5% GDP growth target. Next year’s projection, on the other hand, is well below the 7-9% growth goal set by economic managers.

“The main risk to the outlook is the spread of more contagious COVID-19 (coronavirus disease 2019) variants, leading to the reimposition of strict quarantines and stalling economic recovery,” the ADB said in the report.

The Philippines continues to see a rise in daily new COVID-19 cases, driven by more infectious new variants. As of Wednesday, the Health department reported 15,592 new infections, bringing the active cases to 162,580.

ASIA OUTLOOK

For Asia, the ADB cut its GDP outlook to 7.1% this year, lower than the 7.3% forecast given in April, re

fl

ecting the impact of the fresh

outbreaks, renewed lockdowns

and an uneven vaccine rollout.

“Developing Asia remains vulnerable to the COVID-19 pandemic, as new variants spark outbreaks, leading to renewed restrictions on mobility in some economies,” Mr. Zveglich said.

The ADB also downgraded its outlook for Southeast Asia to 3.1% this year from 4.4% previously, after cutting projections for Indonesia, Malaysia, Thailand and Vietnam.

Its projected growth for the Philippines is likely to be the third fastest in the region, after Malaysia’s 4.7% and Singapore’s 6.5%.

However, the Philippines’ high growth projection compared with most of its neighbors is mainly due to base effects as its GDP shrank by a record 9.6% in 2020, Abdul Abiad, director of ADB’s Macroeconomic Research Division, said at a brie

fi

ng on Tuesday.

The multilateral bank said the Philippine economy is already seeing signs of recovery following the 11.8% expansion in the second quarter on the back of higher household spending and investments.

However, the ADB noted the economic rebound “remains fragile” as the government continues to place cities and provinces, especially Metro Manila, in and out of lockdowns when local coronavirus infections rise.

The government this month adopted a new “Alert Level” system with granular lockdowns to limit the stringent restrictions in areas with high infections while allowing the rest of the economy to function.

“Given the fragile recovery, it’s actually important that support continues right, so one of the things you do want to avoid is premature withdrawal of

fi

scal support and monetary support when a recovery is not yet

fi

rmly entrenched,” Mr. Abiad said.

“At some point, you will need to consolidate but we’re not there yet. One needs to wait until the recovery is well underway before one discusses that,” he added.

The ADB said

fi

scal policy will continue to support growth. “A

fi

scal de

fi

cit is planned at the equivalent of 7.5% of GDP for 2022, with budget expenditure 11.5% higher than in 2021 with larger outlays for infrastructure and social programs,” it said.

Across developing Asia, governments will likely remain supportive of economic recovery before a general shift toward fiscal consolidation starts in 2022.

Mr. Abiad said continued adoption of tax reforms, including raising taxes, is a possible approach the government can take to rebuild its public

fi

nances as part of its

fi

scal consolidation program in the next three to six years.

“They will be helpful in… mobilizing domestic resources, strengthening the tax base and giving government more of the resources it needs to spend on priorities, including health and education and infrastructure and the like,” he said.

On the bright side, the ADB said the Philippines’ vaccination rollout has seen “good progress.”

“The government forecasts that around 80% of the target population in Metro Manila will be fully vaccinated by the end of October, which helps improve the conditions for further easing of mobility restrictions that will help restore consumer and business confidence,” it said.

Key reforms such as easing restrictions on foreign investments through amendments of the Public Service Act, the Retail Trade Liberalization Act and the Foreign Investments Act are also needed, the ADB said.

Meanwhile, the ADB maintained its in

fl

ation outlook at 4.1% this year and 3.5% next year, which are both at the higher end of the Philippine central bank’s 2-4% annual target range.

Monetary policy will also likely remain accommodative for the time being to further support the economy’s rebound since domestic demand is only recovering modestly.